Merrick School of Business

Your Ambition. Our Partnership. Limitless Potential.

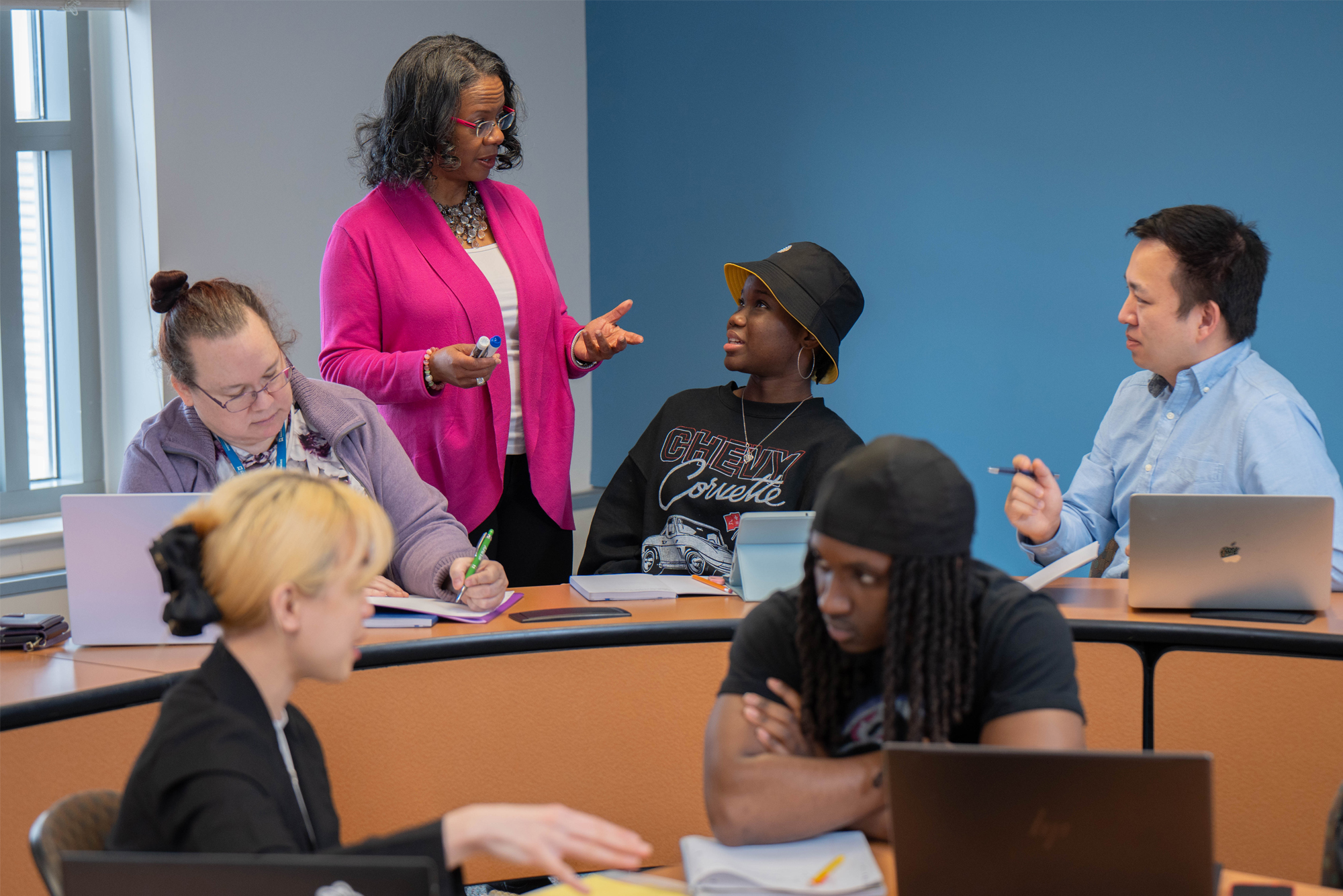

At the Robert G. Merrick School of Business, we're passionate about helping you achieve your career goals. We believe in your incredible potential and are dedicated to empowering you. We're here to turn your efforts into real-world success by providing the support and resources you need to earn your degree and launch your dream career.

We're Partners

in Your Tomorrow.

Let's See Where your Educational Journey Will Take You.

We are different by design.

Don't just adapt to the future of work— define it.

6 Master's Degrees

We specialize in equipping working professionals for success. Our offerings include a Flex MBA with 12 specializations, a Fully Online MBA with 4 specializations, and four Specialized Master's programs, each crafted to maximize your potential.

2 Bachelor's degrees

Ready to kickstart your career? Earn a powerful Bachelor of Science degree! Choose our Business Administration program with 11 specializations, or a focused degree in Information Systems and Technology Management.

25 Full Time Faculty

Real-world career prep takes a team: you and our expert faculty. They blend teaching with scholarly research, sharing invaluable insights both in and out of the classroom to ensure your educational journey thrives.

Key internships elevate MBA candidate’s experience

Read Full Story

UBalt empowers students for meaningful, long-term success by providing an extraordinary, high-value educational experience, featuring passionate, industry-savvy professors, motivated and hard-working peers, small class sizes, and flexible learning options.

UPCOMING BUSINESS SCHOOL ADMISSION INFORMATION SESSIONS

School of Business

Stories and News

School of Business

Events

Why AACSB Accreditation Matters.

A Global Benchmark for Business Excellence

Being your partner for tomorrow starts with having the highest standards for our programs and faculty.

AACSB International stands as the premier global authority and largest network dedicated to advancing business education worldwide. This accreditation represents the pinnacle of academic quality—earned by fewer than 6 percent of business schools globally. Institutions that achieve AACSB accreditation, like the Merrick School of Business, are recognized as leaders in delivering exceptional teaching, driving meaningful research, and creating positive impact in their communities and beyond.

Why it matters to you.

Your AACSB-accredited degree signals to employers that you've mastered rigorous, globally recognized business standards—giving you a competitive advantage in hiring, promotions, and career mobility that opens doors at top organizations worldwide.